Nov 10, 2025

The Transformative Roles of NFC Technology and NFC Forum in the Rapidly Evolving Payments Stack

This paper explores the role that Near Field Communication (NFC) has played in the evolution of payments technology. It differentiates between the broader utilization of NFC technology and NFC Forum’s specifications and protocols, exploring their respective enabling contributions to the evolving payments ‘stack’ - the framework within which software, systems and tools interact with each other to enable payment processes.

Demonstrating the scale and diversity of the current payments ecosystem, this paper charts the rise of a variety of payment options, from contactless to open banking and digital currencies, highlighting the contributions that NFC technology and NFC Forum make today.

Finally, as the payment stack continues to evolve, becoming intertwined with ecosystems including digital identity, access control and transit, this paper looks to the future, highlighting the importance of standardization, certification and collaboration. It invites engagement in NFC Forum from stakeholders seeking to maximize the benefits of NFC-enabled payments through interoperability and technology harmonization.

Contents

Executive Summary

This paper explores the transformative role that Near Field Communication (NFC) has played in the evolution of payments technology. It differentiates between the broader utilization of NFC technology and NFC Forum’s specifications and protocols, exploring their respective enabling contributions to the evolving payments ‘stack’ - the framework within which software, systems and tools interact with each other to enable payment processes.

Demonstrating the scale and diversity of the current payments ecosystem, this paper charts the rise of a variety of payment options, from contactless to open banking and digital currencies, highlighting the contributions that NFC technology and NFC Forum make today.

Finally, as the payment stack continues to evolve, becoming intertwined with ecosystems including digital identity, access control and transit, this paper looks to the future, highlighting the importance of standardization, certification and collaboration. It invites engagement in NFC Forum from stakeholders seeking to maximize the benefits of NFC-enabled payments through interoperability and technology harmonization.

Payment Stack

The payments stack is the framework within which software, systems and tools interact with each other to enable payment processes. It is the result of a complex ecosystem that brings together a wide range of stakeholders, from global payment schemes and multibillion-dollar manufacturers to local vendors and individual consumers.

The Allure of Contactless Payments

Throughout the 21st century, the number of options available for when and where we pay, transfer and transact has grown exponentially. Digital platforms, coupled with the proliferation of smartphones and internet access, have enhanced accessibility to banking services for more people than ever before. And with a higher number of people now holding a bank account thanks to digital first solutions, this naturally brings with it an increased appetite for digital payments.

The rise of digital has also changed what consumers expect from payments. Demand for more convenient and personalized payment experiences across platforms continues to grow. From new ways to pay in-store to transformative eCommerce experiences, a wave of new, innovative payment options have already transformed the payment stack and will continue to do so in the months and years ahead.

Most notable among these new experiences is surely the contactless payment. Launched in Seoul, South Korea in 1995, the first iteration of contactless came in the form of the contactless transit smartcard, and was swiftly followed by contactless prepaid, debit and credit cards. Together, these offered unparalleled payments convenience to the end user, thanks in large part to the standardized NFC protocols, defined by Philips and Sony in 2002 based on ISO/IEC 14443 that provided universal tap and go interoperability with the payment terminals of any manufacturer.

By 2018, the allure of contactless technology had forever changed the payments sector as bank cards had overtaken cash as the most common way to pay in markets around the world including the United Kingdom, the United States, and multiple Northern European nations including the Netherlands and Finland

However, the transformation wasn’t yet complete. The 2024 ABI Contactless Usage and Adoption Study found that, for the first time, the majority of consumers now preferred to use their phone or wearable to pay over a contactless card. The study, which surveyed individuals in nine countries across Europe, North America and Asia, cited security, reliability and convenience of digital solutions as the core drivers of adoption, with NFC as the most well known and most trusted enabling technology.

The study also revealed a marked shift in behavior as well as attitude. Yes, the fact that over 80% of respondents have used an NFC-enabled mobile device such as a smartphone or wearable device to make a payment is significant. A better marker of behavioral shift, however, is that 95% of this group now choose to leave their physical wallet or purse at home and instead rely solely on digital payment solutions. Furthermore, contactless payments using an NFC mobile device were ranked by respondents as the most secure and trusted way to pay, ranking above even cash.

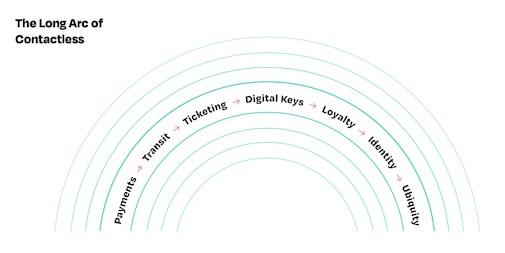

The device first shift is not just exclusive to payments though. More and more sectors are being incorporated into multi-service offers. Access control, loyalty schemes, identity verifications and more are all now looking to harness the power of NFC-enabled mobile devices. Creating a payments stack that enshrines the seamless UX that consumers now expect while also incorporating any potential new use cases and services requires standards, testing, trust, cooperation, and, crucially, a common understanding.

Led by its Board members, including representatives from Apple, Google, Huawei, Identiv, Infineon, NXP, Sony, and ST Microelectronics, NFC Forum has helped in the creation of seamless, secure payment solutions. It works closely with EMVCo and its members as well as industry leaders in the transport ticketing space, to create a platform for strong, industry-wide collaboration. This paper will explore the clear growth potential for NFC in the payments sector, and offer insight into how with the collaborative work of the NFC Forum, the technology has the potential to deliver a next generation multi-service payment experience.

Why Standards?

When markets need to align and combine to deliver joint services, the ‘rules’ of interaction need to be clear to ensure that different applications or solutions do not disrupt or impact another service or component

Industry standards are vital in achieving this. They set a baseline framework that enables all players to build and design products that will perform as intended, interoperate as expected with other solutions, and provide the reliable and seamless experiences anticipated

Realizing Potential in Payments

NFC technology has proven to be a key accelerator for contactless payments. Such transactions were originally defined by EMVCo, which expanded on its existing contact specifications to develop contactless EMV® chip payments. Based on ISO/IEC 14443, this created the framework for the interoperability and security that the card and terminal payment landscape has been built upon.

The specifications designed by NFC Forum integrated the existing interface technology standard laid out in ISO/IEC 14443 and added innovative contactless interface capabilities allowing devices to take multiple roles including both that of a reader and as a card device. Breaking up the traditional roles of pure reader or card enabled an era of new use cases and new device form-factors, while still being compliant to ISO/IEC 14443 and the established EMV® contactless infrastructure. This was the result of close industry collaboration between organizations that has helped significantly elevate the appeal of contactless payment acceptance. Achieving this significant milestone, NFC Forum specifications could build the foundation for the next evolutionary set of EMVCo contactless specifications, maintaining global interoperability and security in the payment industry.

Nowhere did this have a more significant impact than in the proliferation of device-first payment solutions. NFC Forum’s Type A and Type B protocols were both built based on the existing requirements of ISO 14443, meaning that any compliant NFC-enabled mobile device was compatible with the EMV contactless specifications when operating in either reader or card mode. Alongside this, the NFC Controller Interface (NCI) Technical Specification defined the interface between the controller and host at device level into a standardized language, making it easier for device manufacturers to integrate chipsets from different chip manufacturers.

This unlocked a host of new form factors, most notably digital wallets in smartphones and wearables, which when partnered with the support of leaders in the OEM Pay ecosystem such as Apple Pay and Google Pay, helped boost existing contactless payment use cases and applications while spurring adoption in less mature EMV markets.

NFC Forum has therefore played the role of a facilitator in the payments space. It has been instrumental in meeting the growing user demand for device first solutions in a way that interacts with existing hardware and architecture, thereby helping to avoid the requirement for significant investment in new payments terminals. It has also helped to define standardized requirements for antenna, secure elements and other associated components that made sure that hardware manufacturers, payment service providers, card schemes and any other relevant parties are able to access and interact with the frameworks of the payment ecosystem.

But much like the ecosystem itself, NFC Forum’s position within the payments stack is dynamic and ever changing.

The global payments landscape is both broad and constantly evolving, and the contemporary appetite for device first digital solutions has challenged existing payment architectures like never before. Innovators are always looking for ways to transform the scope and capabilities of the payments ecosystem to meet the changing user expectations of the modern, digital world.

This forms the “Long Arc of Contactless”; an inevitable and accelerating adoption of NFC technology that diversifies its use cases and the possibilities it unlocks. Payments has been foundational in creating an environment of trust in NFC as a secure, convenient and reliable solution. From this position, NFC technology is well positioned to enter more and more use cases, and with the direction of NFC Forum, payments can be seamlessly intertwined with a host of other use cases to create ergonomic digital services.

Establishing a clear position of NFC Forum within the expanding payments stack is therefore fundamental to understanding the future of both the industry and the technolog

Reader Mode Payment

Also known as Tap-on-Mobile or SoftPOS, allows merchants to use their own NFC enabled devices to accept contactless payments. This mitigates the need to invest in expensive purpose-built hardware, bridging the gap between the need to boost digital payment acceptance and the barriers of affordability.

1. NFC Release 15 and Extended Payment Options

NFC Release 15 has extended the range – also known as the operating volume – of NFC contactless interactions from 0.5cm up to 2cm. A larger more stable operating volume means that connection will start sooner and require less precise device alignment, making the user experience faster and more consistent while reducing occasions where consumers may need to tap or align devices more than once.

And while this increase is significant, it remains within reason. There is a delicate balance for OEMs to strike between improving performance, managing power consumption, and maintaining the required antenna size to fit within the compact form factors of today’s devices. Additionally, this preserves the crucial notion of user intent. Users retain the sense of control that comes with NFC as the exchange between two devices can only begin when the deliberate action is taken to tap two devices together. Within payments, this is critical as users must be able to trust that only payments that they intend can be taken.

Payments is not the only market that stands to benefit; NFC Release 15 optimizes NFC usability within automotive; it enables quicker throughput volumes within high-capacity sectors such as public transport; it enables NFC to be used in new environments where connection points need to be at a greater distance. However, it is within payments that NFC Release 15 could have its most significant impact through its augmentations of Reader Mode Payments.

Momentum for such solutions is already strong. EMVCo’s dedicated testing approval process is designed to promote a seamless experience when smartphones and other handheld mobile devices are used to accept contactless payments. However, for adoption to reach its full potential, it is essential that these emerging solutions provide the same levels of performance and security as their legacy counterparts.

Some within the industry have previously expressed concern about the performance of Tap-to-Mobile / SoftPOS devices in comparison with dedicated Point Of Sale (POS) terminals. The increased operating volumes brought in by NFC Release 15 addresses these concerns directly, giving traditional payments leaders, the exclusively online neobanks and other stakeholders alike the opportunity to design applications that harness secure, dependable NFC connectivity using readily available hardware. This means that next generation payment solutions will be available more merchants and vendors than ever before. NFC Forum is also working with system integrators and software vendors to add iconography to the smartphone terminal screen that helps guide the user in their device placement. With these concerns already well on the way to being addressed, NFC Forum’s role within the payments stack is clearly growing.

2. Payments and Digital Identity

Payment fraud is rising. At the forefront of this rise is card ID fraud. The 2024 UK Finance Annual Fraud Report stated that its last reporting period saw a 53% increase in total losses, and a 74% increase in the volume of these type of attacks. Unsurprisingly, stringent authentication is therefore a key priority for today’s payment stakeholders.

National and pan-continental institutions are already exploring options for digital wallet solutions that integrate payments and identity to meet this rising threat directly. In Europe, Electronic Identification, Authentication and Trust Services (eIDAS) regulation is already in place with the objective of creating a more secure environment for transaction services throughout the EU. Meanwhile, the continent’s executive body, the European Commission, has outlined its Digital Decade Policy Programme with the stated objective of achieving universal Digital ID access through the European Digital Identity (EUDI) Wallet by 2030.

NFC Forum solutions have helped significantly enhance identity verification processes. By building on trusted interoperable standards, providers can develop a fast, secure, and convenient method to transfer and verify the authenticity of data on personal digital identity credentials. These solutions can transform access control and make use cases such as air travel seamless thanks to digital travel credentials, but it is the applicability in payments that could have the biggest impact.

Enhanced, robust verification methods that leverage NFC to enact multi-factor authentication could mitigate card-not-present fraud by requiring a user to tap their card against a smartphone to verify a payment. Meanwhile, combining digital ID initiatives with new digital currencies, as is planned for the Digital Euro and EUDI wallet by 2027, could ensure Account-to-account (A2A) digital payments can only be made in conjunction with proper identity verification processes.

These solutions not only offer easy, secure access for users, but they also empower merchants to confirm a customer is of the correct age to purchase certain goods before being able to take payment.

Undoubtedly, digital wallets will become central to how we transact. NFC technology already enables digital identity and payments use cases, and so as stakeholders look to combine these two under initiatives such as the EUDI, NFC Forum can play a pivotal role. With a membership of composed of industry leaders across both these verticals, the Forum sits at the intersection of payments and digital identity, putting it in a strong position to defining how they can interoperate in a way that is mutually beneficial to all stakeholders.

3. The Potential of Multi-Purpose Tap

The world’s evolution into a digital society is fueling consumer appetites for efficient, ergonomic and environmentally friendly solutions. And as the number of industries creating smart solutions grows, so too does the demand for these services to work together to augment the overall UX.

NFC Forum is attempting to revolutionize the contactless user experience through the introduction of multi-purpose tap. This concept aims to facilitate multiple actions at once with a single tap of an NFC enabled device, and nowhere will its impact be more profound than in the payments space.

With millions of people already using NFC to pay for goods and services every day, the ability to securely pass several layers of information in a single tap opens up a myriad of options for enhancing the user payment experience:

Simultaneous point-to-point receipt delivery,

Automatic identity verification to provide, for example, proof of age when purchasing restricted goods such as alcohol,

Rewards and discounts from loyalty schemes are updated with the same tap that confirms the associated payment,

Tap and go total-journey transport ticketing that automatically applies the correct taxes and concessions.

Multi-purpose tap can also help drive initiatives such as the Digital Product Passport. This regulation will mandate that the composition and provenance of a product is readily available at any point in its lifecycle. Using NFC multi-purpose tap for this would allow the required data to be transferred to the new owner when they go to pay, while also creating a clear and infallible chain of custody for the product. By facilitating this use case, NFC Forum is helping to meet consumer demands for more sustainable practices, combatting “greenwashing” by providing transparent data, and promoting healthy circularity across the global economy.

Multi-purpose tap is undoubtedly an exciting prospect that looks set to transform how our devices interact with each other. Nonetheless, currently it remains in the ideation stage. NFC Forum is carefully evaluating the requirements of each market that multi-purpose tap stands to benefit and continues to encourage all stakeholders from across the NFC value chain, such as relying parties, solution providers, mobile device OS providers and reader terminal manufacturers, to contribute to the standards-setting work to ensure that its unique value is accentuated for each individual use case.

Driving Innovation with NFC Forum

The digital push across almost every sector, supported by the landmark concept of multi-purpose tap, engages stakeholders from throughout the NFC value chain, and therefore redefines how each level of the payment stack interacts. NFC Forum has led the way in defining interoperable, functional standards to enrich the payments space. The contributions of NFC Release 15 are helping to further improve the user experience of NFC, bringing trusted digital payments to more people than ever before. It blends together dynamic sectors including payments, digital identity, access control and sustainability to create a harmonious digital ecosystem in every smartphone.

This innovation demonstrates what is possible with strong industry collaboration. So what’s next for NFC in payments? Section two of this paper explores some of the most exciting emerging concepts and offers insight into how NFC can help make them a reality.

Interoperable Solutions and Future Developments

As the key facilitator for countless contactless use cases, and thanks to its contributing membership from across each of these verticals, NFC Forum is the nexus not just for payments, but for all interconnected digital services. Future evolutions to the payment stack and their implementation strategies must consider how they will engage with other connected APIs and integrated services. And with an increasing number of stakeholders looking to bypass legacy payment and banking systems, NFC Forum is working harmonize and extend existing contactless standards across modes such as card emulation and reader/writer, playing a pivotal role in ensuring that interoperability and integration remain strong.

Regional disparity poses an additional challenge to implementing new payment solutions. Yes, today’s global digital payments ecosystem is more interconnected and interoperable than ever before. However, as this section of the paper will explore, its services are also hindered by a plethora of intractable challenges, the impact of which varies enormously around the world. Access to technology, digital literacy rates, and even personal preference are all variable factors that dictate how each region approaches payments. Payments in APAC markets, for example, are rapidly shifting from cash to digital wallets thanks to the availability of app-based solutions from non-banking entities such as AliPay in China or Global Payments in the Philippines. In sharp contrast, the United States has fallen behind in mobile payment adoption.

With these regional differences in mind, one of the key priorities for NFC Forum is to leverage its global membership to create standards that promote harmonized ecosystems which also remain flexible to meet unique local and regional needs. Next, therefore, we will explore the changing ways consumers are looking to transact, and how this is impacting decision-making for product managers, payment schemes, service providers and banks alike.

Serving the Unbanked

In Brazil, digital banks allow users to open an account with just a selfie for ID verification. A report by Instituto Locomotiva cites this as one of the primary drivers of enrolment as the nation was able to cut its unbanked population from 16.3 million in 2021 to just 4.6 million in 2023. In India, meanwhile, account ownership grew from 35% to 77% in the decade between 2011 and 2021, hovering between 77-80% in the years since.

1. The Rise of Open Banking

In an increasingly digital payments industry, the volume of financial data being processed has risen exponentially. In response, open banking has emerged as an alternative means of sharing payments data and account information. Open Banking allows banks and third-party service providers to share this data, subject to customer consent, via dedicated Application Programming Interfaces (APIs) which, in turn, allows these stakeholders to develop new and innovative payment and account information services that operate independently of legacy banking infrastructure and conventional payment networks.

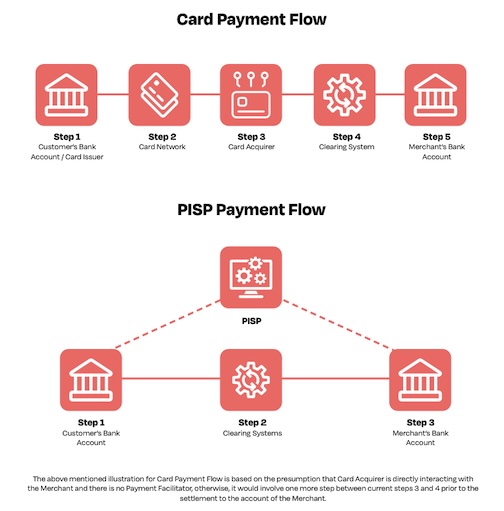

Open Banking service providers such as Token.io and Tink offer secure API connectivity that allows banks and payments service providers to bypass the traditional linear card payment flow. As shown in the adjacent diagram, it enables a more direct path that uses a Payment Initiation Service Provider (PISP) to connect the customer and merchant bank accounts directly, bypassing card networks and legacy systems entirely.

The concert of open banking connectivity and the digital-first approach is driving a new era of financial inclusion, the impact of which is most notable in emerging economies. Here, access to fixed line payment infrastructure is limited, and the cost of legacy payment terminals is a financial barrier too large for many to overcome. Taking advantage of year-on-year increases in smartphone penetration globally, the vast majority of which have NFC as standard, has allowed schemes such as UPI in India, PIX in Brazil, and RTC in South Africa to flourish.

The concert of open banking connectivity and the digital-first approach is driving a new era of financial inclusion, the impact of which is most notable in emerging economies. Here, access to fixed line payment infrastructure is limited, and the cost of legacy payment terminals is a financial barrier too large for many to overcome. Taking advantage of year-on-year increases in smartphone penetration globally, the vast majority of which have NFC as standard, has allowed schemes such as UPI in India, PIX in Brazil, and RTC in South Africa to flourish.

Open Banking is creating never before seen levels of digital financial inclusion. It is also setting the stage for A2A to become a reliable and realistic solution for one-off payments in day-to-day life.

Most users of online banking will already be familiar with A2A transactions as they are already frequently used in peer-to-peer payments, for bill or salary payments, and increasingly for wallet load and credit card payments. They bypass intermediaries in the payments stack and their respective interchange and handling fees to make transactions faster and more cost effective. Such fees have risen 30% between 2019 and 2024 and, as a result, present an increasing threat to the margins in a number of payments use- cases.

Lithuanian fintech kevin developed an NFC based solution that leverage open banking principles to allow European merchants to accept A2A payments through POS terminals. And it’s a similar situation with cross-border payments, where the enhanced data sharing capabilities of open banking and seamless A2A interactions mean that funds can be transferred without the need to interact with the Society for World- wide Interbank Financial Telecommunication (SWIFT) network.

This new way of banking brings with it new payment solutions and is gradually transforming how both businesses and individuals interact with their money. By opening up data, a new era of financial manage- ment solutions is emerging.

2. New Money Management for Users

In parallel with the emergence of open banking, a new wave of digital only, app-native financial service providers, known as neobanks or challenger banks, has gained significant traction. This new category comprises of fully licensed banks, together with prepaid and e-money service providers. Collectively this category offers a similar service portfolio to their traditional counterparts, and is principally differentiated by a more flexible and personalized user experience, a more convenient, fully digitized onboarding process, and the absence of physical branches.

Monzo, Revolut, N26 and more are already taking over a significant market share through their “all-in-one finance app” approach to banking solutions. A reported 50% of UK adults now hold at least one card with a neobank, up from just 16% in 2018. Further to this, 9% of adults in the UK use a neobank as their main debit card, in no small part because their offer meets user demands. 55% of respondents to the 2024 NFC Forum and ABI Research Usage and Adoption Report stating their preference for digital transactions over those using a physical card. Neobanks have responded to this quickly, issuing payment cards straight to the user’s phone.

Payments “Super Apps” are primed to take advantage of this trend, especially in APAC markets where smartphone penetration and the adoption of A2A digital payment solutions has already taken root. WeChat Pay in China, Rakuten Pay in Japan and Kakao Pay in South Korea have all established strong penetration in their respective markets, doing so off the back of simple Quick Response (QR) code payment options. QR codes are quick and cost effective to deploy, making them extremely appealing for the growing number of A2A payment use cases.

It is, however, important also to recognize that QR codes have notable shortcomings. Using wearable devices to make payments is becoming increasingly popular, however such devices often do not have the hardware to read QR codes. Meanwhile, the ease with which a QR code can be produced and placed strategically makes them valuable to nefarious actors performing phishing or hacking attacks. Security and criminal tampering has become a major issue in sectors such as paying for car parking, where fake codes are stuck over the top of genuine ones, fooling unsuspecting users into paying into a criminal’s account. Unlike NFC card payments, which benefit from thorough industry regulation and have standards governed by organizations such as NFC Forum, QR payments in Europe remain unregulated which, combined with the threat of scams and the requirement for a stable internet connection, has lowered user trust and, in turn, stunted adoption.

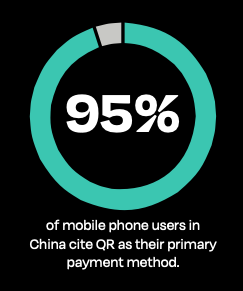

Small businesses and street vendors can use QR to take digital payments without requiring any investment in hardware, meanwhile an increasing number of utilities, eCommerce and governmental services now include an option to pay using a QR code printed on a letter that is sent through the post. It therefore comes as no surprise that over 95% of mobile phone users in China cite QR as their primary payment method. In Europe, meanwhile, QR code payments have established a foothold primarily in closed-loop solutions like loyalty cards and transit ticketing. Here, rising transaction fees are driving interest from merchants in these more affordable QR A2A solutions.

3. Securing Transactions

Cyberattacks and data breaches in the payments ecosystem can have catastrophic consequences. Any failure could lead to the loss of a customer’s money and their data, causing immense reputational damage to the service provider at fault. Putting proper security measures in place at every stage is therefore vital.

82% of card-based fraud occurred in online transactions, highlighting the clear vulnerabilities this channel has compared to using a card in-store. Furthermore, artificial intelligence and deepfake technology have completely transformed the threat landscape, making proper authentication tools more important than ever at any digital checkout.

Protocols such as SSL/TLS (Secure Sockets Layer/Transport Layer Security) can provide authentication for the connection between the client and server. This level of protection is already mandatory for high value transactions in certain places such as India where those that exceed ₹5,000 (Approximately US $55) are mandated to use end-to-end secure protocols. These protocols help protect data in transit, however they cannot be used in isolation. Should a mobile device be lost or stolen, the payment credentials and financial data stored on it are at risk. Additional security must therefore be provided at the user interface itself.

A popular way to safeguard transaction on the device itself is through biometric authentication. This approach uses fingerprint or facial recognition using the fingerprint scanner or embedded camera respectively that are already in place on most smartphones to strengthen user authentication via a seamless user experience that works for both online and in store purchases. And in the rapidly evolving threat landscape that has arisen as a result of the evolution of AI, the testing and certification of these authentication solutions is increasingly sophisticated to address the danger of deepfake fraud.

Threats posed by AI are also being addressed within the digital wallet itself. Web3 authentication concepts are built on cryptographic keys and digital signatures stored on the blockchain. Applying the same concepts to digital wallets means that all information - from the user’s personal details to the raw card data - can be tokenized. In doing so, this ensures a seamless and highly secure authentication process for digital wallet payments that safeguards data security.

The use of NFC Forum technologies can therefore play an important role in further augmenting device-first payments security by serving as an extra authentication factor. NFC can include a Message Authentication Code (MAC) with the payment message to ensure the source is correct. Additionally, some banks now allow customers to authenticate transactions within open banking portals by using both the biometric authentication on their smartphone and by tapping their physical bank card against their NFC-enabled mobile device. This uses something the user is (their biometric), and something they have (their payment card), to provide multi-factor authentication. By unlocking an extra factor using a compatible smartphone that a majority of people already own, NFC can further protect digital transactions by eliminating the risk of card-not-present fraud.

Payment Rails

Payment Rails are the systems and underlying infrastructure upon which the transfer of funds can occur. Costs for using certain rails can vary based on security, transfer speed, and their ability to manage cross border payments.

4. Digital Currencies and Economic Sovereignty

As well as creating a number of digital first payment methods, technological advances in recent years have also given rise to digital currencies. While a huge number of decentralized cryptocurrencies have been created and some like Bitcoin have become respected, a lack of regulation in this space has created a volatile market awash with dirty money and plagued by security risks and scams, as reported by the US Federal Trade Commission.

That said, centralized initiatives to regulate digital currencies are beginning to take hold. So called Central Bank Digital Currencies (CBDCs) are digital versions of already existing fiat currencies. As these are regulated and a direct liability of that currency’s central bank, they are more trustworthy than other digital currencies, and a number of deployments are already underway. Arguably the most ambitious and comprehensive of these is the Digital Euro, which aims to unite central banks in creating a digital currency for all member nations. Its objective is to create a seamless digital payment ecosystem leveraging the NFC capabilities of the smartphones and wearable devices that already enjoy very high penetration rates throughout Europe. The European Central Bank has outlined its target to deploy a system capable of handling over 50 billion transactions each year from the outset, demonstrating clear intent to transform the retail payments market.

Efforts are not limited to Europe though. Nigeria’s eNaira is already in circulation, meanwhile China’s Digital Yuan and India’s Digital Rupee are already in pilot phases. A Digital US Dollar is also in discussion.

The reason behind this interest is clear. John Barrdear and Michael Kumhof, senior economists for the Bank of England, published a report concluding that GDP could be lifted by as much as 3% through an adoption of digital currency. This uplift comes thanks to the resultant efficiencies in financial systems and reductions in transaction costs which, in turn, allow for reduced distortionary taxes. CBDCs can also help mitigate the impact of geopolitical divisions. As recognized by Jens Larsen, Head of Geopolitics at Eurasia Group, sovereign digital payment infrastructures allow governments to meet these challenges head on while retaining full control over their financial systems, eliminating the vulnerabilities associated with dependencies on foreign, privately held payment firms, and while reducing the impact of interest charged on lending agreements.

Both physical NFC cards and cards stored in mobile wallets are able to store CBDC directly on them. This allows users to make instant tap to pay transactions at a compatible POS terminal without the need for internet connectivity. These transactions do not need to use traditional payment rails and banking infrastructures, and so can make contactless payments seamless while avoiding high interchange and transaction fees that are typically anywhere between 0.5% and 5% of the value of the transaction. Furthermore, while physical currencies require paper or plastic bank notes to be put into circulation, digital currencies do not need such resources to be created, nor do they need to be destroyed when being taken out of use. This means that digital currencies are helping advance dematerialization objectives and champion a sustainable future.

With the use of cash fading fast in favor of digital alternatives, the payments ecosystem has become increasingly reliant on 3rd party schemes and intermediaries. Card networks are central to everyday transactions, while big tech wallets are increasingly the primary user interface for payments. CBDCs give central banks a way to preserve their sovereignty and authority over their currencies serving as a digital equivalent to banknotes. Developing such solutions based around turnkey NFC Forum solutions allows central banks to provide the user with a familiar, secure user experience that makes deployment and adoption seamless, while elevating the economy as a whole.

Understanding the Market

The trends reviewed in this section emphasize both the scale and diversity of the current global payments ecosystem. For those seeking to operate globally, it is imperative that macro trends of digitization do not eclipse the regional nuances and preferences that will be key to any successful deployment. At the same time, it’s clear that growing populations, increasing financial literacy and the expansion of accessible internet have set the stage for a new generation of seamless, interconnected payments with NFC Forum technologies at the heart.

Trusted global specifications such as those of NFC Forum allow terminal vendors, OEMs and OS providers to deliver state of the art solutions to numerous markets that can then be tuned to meet regional needs while still providing the same consistent user experience.

Looking to the Future

NFC Forum Sets the Foundation for Interoperability

The uses for NFC Forum technology have now gone well beyond its origins as a data carrier that can support payments. It has cemented itself as a baseline technology for many of the innovative form factors we now all take for granted in contactless payments, opening up the digital economy to more people than ever before. Furthermore, thanks to the increasing prevalence of digital first solutions and the penetration of smartphone and wearable devices, it has undergone a perception change with payment acceptors and their customers around the globe. It is now considered a fundamental technology to modern life that underpins a wide variety of applications and use cases, from transport to healthcare to digital ID. It is well known in payments as the facilitator of seamless tap and go solutions. The move to integrated, digital first solutions now requires it to be more than the facilitator for these services; it must take its place as the very foundation of them.

NFC is by no means alone in this space. QR already has a notable market share and, despite its security fallibilities, has demonstrated its value in a number of use cases. Meanwhile Ultra-Wideband (UWB) technology shares many common use cases with NFC. To help it meet these needs, FiRa® Consortium has released its Core 3.0 Specifications and Certification Program, which offers notable enhancements to the efficiency and versatility of UWB systems. Its Hybrid UWB Scheduling (HUS) feature optimizes its performance in complex environments such as public transport and opens the door to some truly seamless applications that take out user intent requirements to initiate and complete the contactless interaction

The conversation on the payments stack must therefore consider where UWB fits, and how it can coexist and even complement NFC. Looking to the automotive industry, Car Connectivity Consortium (CCC) has already demonstrated how this is possible with its Digital Key Release 3.0. This specification uses the advantages of NFC to mitigate the shortcomings of UWB to create a multifaceted solution for the betterment of the overall product. Recognizing and taking advantage of complementary functionalities could help optimize payment solutions.

Standardization, Certification and the Value of Collaboration

NFC Forum members represent a cross-section of the payments ecosystem, bringing together hardware manufacturers, software providers, end users, and other stakeholders from throughout the NFC value chain. The Forum creates a platform for strong industry-wide collaboration to create interoperable standards that harmonize the ecosystem and help create seamless, secure payment experiences.

Through this collaboration, NFC Forum has a clear roadmap for the future of NFC technology, and some of the key contributors to this have come from the payment stack. From mobile-first payment architectures and multi-purpose tap functionalities to reinforced security measures and sustainability-driven initiatives, the way we pay, receive payments, and engage with our favorite brands is changing. NFC Forum’s Roadmap ensures that solutions built on this technology remain an indispensable part of future-proof financial ecosystems.

At the heart of its work, the NFC Forum Certification Program makes sure that millions of products from countless different manufacturers and service providers work flawlessly with one another. Unlike many other standards organizations, NFC Forum Certification is open to non-members. The program confirms that devices are Certified Compliant with NFC Forum Specifications. Conformance to the specifications provides consistency of behavior across NFC implementations and sets the foundation for interoperability, not just for the payment stack, but for the entire integrated digital world.